APAL’s Economist, Yang Song, has identified which countries would benefit most from recent currency exchange rate movements and therefore would be good for Australian exporters to target.

Her report analyses the exchange rate movements of major Australian apple and pear trading partners across 22 countries from 2007 to 2015.

Up until 2013, the Australian dollar (AUD) appreciated strongly against the US dollar (USD), rising from US $0.7939 in 2007 to a peak of over US $1.1055 in 2011, making exports of Australian apples and pears uncompetitive. Then, in June 2013 it started depreciating, providing an advantage for Australian apple and pear exporters.

This report examines the AUD performance against the currencies of importers and export competitors. It confirms that Australian apple and pear export opportunities have improved in certain countries, especially those countries that fix their exchange rate to the US dollar (USD).

Exchange rate trends: what they mean for Australian exporters

The exchange rate has a significant effect on international trade. An undervalued or depreciating currency favours domestically produced tradable goods, protecting domestic firms from imports and giving them an incentive to export.

Measuring the exchange rate, the value of the AUD is generally reported as a nominal bilateral rate against the USD. This report shows the value of the AUD, rising and falling against a number of different currencies.

Up until 2013 when the AUD was appreciating, exporting was a challenge for Australian producers because it was more costly for buyers to purchase Australian fruit. The situation also made the pricing of other Southern Hemisphere apple and pear producers more competitive compared to Australian producers.

The decreasing value of the AUD since 2013 now provides Australian exporters with an advantage.

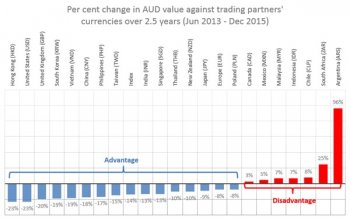

APAL looked at the percentage changes of the exchange rate of the AUD against a number of trading partners’ currencies over the last nine years, focusing on the last two and a half year period, because this is when Australia had seen the greatest depreciation, leading to a significant potential up-side for Australian exporters.

Between 2007 and 2015, the AUD depreciated against nine countries including major trading partners, the United States, China and Japan. Of greater relevance today is the results when we look at the last 2.5 years of the depreciating Australian dollar, showing an improved position in 15 of the 22 countries that the country trades or competes with.

When the AUD becomes weaker, Australia’s exported products become relatively cheaper to Australia’s trading partners. It also indicates that Australia’s exported products are more competitive against other producing countries that have a focus on exporting into like markets.

Which export markets should be targets now?

It has become increasingly advantageous over the last two and a half years to export Australian apples and pears to Hong Kong, United Kingdom, Vietnam, China, Taiwan, Singapore, Thailand, New Zealand and Europe as the AUD has depreciated against their respective currencies.

It is also worthwhile to note that in APAL’s recent report on Australian apple exports in 2015, that the United Arab Emirates grew significantly as an export market. Unfortunately at the time of preparing this report the peak industry body did not have the full exchange rate history for the United Arab Emirates dirham (AED), but in future analyses it would be interesting to include the AED, too. Also of note are the improved opportunities in India.

Who’s more competitive now?

The percentage change in the AUD against the currencies of other countries that export apples and pears – Australia’s competitors – also helps to assess opportunities. Unfortunately in the last 2.5 years, the AUD appreciated against key competitors’ currencies including Chile, South Africa and Argentina – making them more cost-competitive.

Conclusion

The depreciating Australian dollar over the last 2.5 years means Australia’s exporting opportunities have improved in comparison to some countries, especially countries whose currency is linked to the USD.

In the last year, Australian apple and pear export volume have increased. And while there is limited evidence to suggest that this occurred because of a depreciating AUD (it is certainly a contributing factor), there is an opportunity for Australian exporters to take advantage of the lower AUD value in certain markets to improve their export volumes and profit. Plus, APAL suggests, the more Australia exports the better the domestic supply and pricing is.

Classifieds

Classifieds